This week, we present Chapter 2: Shifting Clouds and Changing Rules. This is the third post in a series dedicated to helping MSPs understand and adopt the recommendations of Consumption Economics–The New Rules of Tech. Chuck introduces the chapter by sharing how the content resonates with his 30+ years of industry insight.

A FEW WORDS FROM CHUCK

The first blog post in this series introduced the seven shifts for technology companies as predicted by Consumption Economics. The authors were very confident that these shifts, along with new types of customer demands, would profoundly impact the way technology companies do business. And they were right. The Cloud has become a legitimate competitor for technology VAR’s and MSP’s traditional product offerings and it has forever changed the business model.

Take a minute to think about how the Cloud has impacted the way your company operates. Have you experienced a reduction in high-margin professional services revenue? Are you searching for recurring revenue streams? Does your business model align with your customer’s buying behavior? Do you find yourself doing fewer traditional installs and signing fewer maintenance agreements? To what degree has the Cloud affected your customers? Have their needs and demands changed since the advent of the Cloud? Are they seeking technology with minimized complexity and reduced costs? Do they refuse to buy premise-based products and prefer the pay-as-you-go model?

The modern day technology consumers are savvy and expect simple, low cost, low risk technology solutions. This is a complete 180 degree turn from 30, 20 or even 10-years ago. It is the reason that technology VARs and MSPs need to reevaluate their business model. If it has shifted out of alignment because of the Cloud or the economy, be prepared to pivot and take action to drive profitable growth. The successful VAR and MSP will assume much more (maybe all) of the financial risk as customers engage with their products and services. Companies will have to invest in their customer success—not just setting up the products, but also helping the customer actually use (consume) their capabilities.

AN EXCERPT FROM Consumption Economics—The New Rules of Tech

Chapter 2: Shifting Clouds and Changing Rules

Chapter 2: Shifting Clouds and Changing Rules

The cloud has buzz. The media is citing it as the next “big thing” in tech. Traditional tech companies are running around figuring out who to acquire to stake their claim in the next big gold rush. But wait! What, exactly, is the big deal?

Larry Ellison, CEO of Oracle, is on record as saying the cloud is just the mainframe reincarnated, and he has a good point. Is it really a big deal where the software and hardware are hosted or how cheap an endpoint device you can get away with? No. That was the whole mainframe model. We would also argue that it’s not whether you rent or own. The “XXX as a service” model has received a lot of focus. But paying over time rather than paying up front is not unheard of. Capital equipment has been leased or financed for years.

So, then, what is the big deal about the cloud? At TSIA, we think seven shifts will profoundly affect how tech companies operate, differentiate, and make money:

- The risk in the purchase decision will shift from the customer toward the supplier.

- Complexity’s long and illustrious reign will end. Simplicity will be king.

- Cloud customer aggregators will shrink the direct market for tech infrastructure providers.

- Big changes will come to the channel ecosystem.

- Cheaper enterprise software will emerge.

- IT departments will “get out of the way” of end users.

- Tech companies will capitalize on user-level behavioral data.

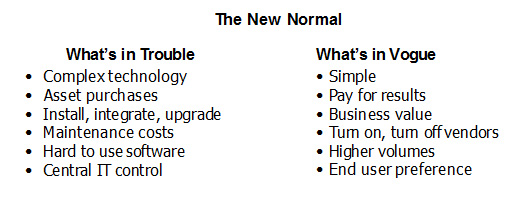

These seven shifts could profoundly impact existing tech company models. Not everyone will like them; not everyone will want them. In fact, many existing tech companies will fight against them tooth and nail. How tech companies succeed and why they fail may never look the same again. The tools to deliver value have never been this exciting before! It could truly be time for a “new normal.”

We will look at some of these shifts and the new normal in coming chapters of this book. But first let’s take a deep and important look at the way commoditization plays out in the unique world of technology products. We are not selling wheat futures or pork bellies here. Commoditization in the “old normal” of tech is not a simple story. We have a perspective on the Consumption Gap’s role in causing it and customer lock-in’s role in preventing it. This perspective might not just open your eyes to the true effect of category commoditization in your markets, it may also give you unique insight in how to reverse the trend.

Because D3UC is dedicated to and entrenched with the MSP community, each week a new chapter of Consumption Economics will be discussed with emphasis focused on the challenges faced by VARs and MSPs who are transforming their companies’ business models to survive and thrive in the new, Cloud-driven world.

If you would like an overview of the book Consumption Economics, you can download a copy of the “abridged” version written by the TSIA from our website.

Week 2: How Good We Had It: The Money-Making Machine Known as High-Tech

Week 3: Shifting Clouds and Changing Rules

Week 4: Looking Over the Margin Wall

Week 5: Learning to Love Micro-Transactions

Week 6: The Data Piling Up in the Corner

Week 7: Consumption Development: The Art and Science of Intelligent Listening

Week 8: Consumption Marketing: Micro-Marketing and Micro-Buzz

Week 9: Consumption Sales: After a Great Run, the Classic Model Gets an Overhaul

Week 10: Consumption Services: Will They Someday Own “The Number”?

Week 11: How Fast Should You Transform?

Week 12: A Few Words From Chuck – The Epilogue

Published: May 2015

Reviewed: November 2016, March 2018